Is VOYA Stock Halal and Shariah Compliant?

No, VOYA (Voya Financial Inc) Stock is Shariah Not Compliant

Is VOYA – Voya Financial Inc Stock Halal to Invest in?

As of February 2026, Voya Financial Inc is Shariah Not Compliant. This is based on the last earnings report.

Sign up to see how many standards the stock passes. Get detailed Shariah screening report on Muslim Xchange. We screen based on five major Shariah standards (AAOIFI, S&P Shariah, Dow Jones Islamic, FTSE Shariah, and MSCI).

Do I need to purify my investment in VOYA – Voya Financial Inc

If the Company is Shariah Compliant and Halal to invest in, then you must purify if the company has any impure income and you hold the company for more than a financial period (e.g. quarter), according to AAOIFI standards.

How can I calculate purification and zakat for my shares in VOYA – Voya Financial Inc

You can use our Purification and Zakat calculator to calculate the amount you must pay for each of these requirements, provided the company is Compliant. You can also use upload or connect your Portfolio(s) to automatically calculate the Purification and Zakat for all your holdings.

You are Seeing a Limited View

Unlock Industry-grade Shariah Compliance for global stocks.

Trusted by Islamic funds managing $2B+

- Detailed Shariah Compliance Report for 5 standards

- Reliable screening by AAOIFI Certified Shariah Advisor & Auditor

- Purification & Zakat Calculator

- Link or Upload Portfolios

- Advanced Fundamental & Technical Research

- 10 years of financial statements

- Halal Stock Advisor

- ... and more!

Join hundreds of elite investors

Beat the Market with

Halal Stock Advisor

▲26.18%

Avg. Returns per pick

We recommend stocks for investors who care about both: performance and Islamic values

- Monthly stock picks

- In-depth company and industry analysis

- Shariah compliance for global stocks

- Join community of savvy Muslim investors

Join hundreds of elite investors

Beat the Market with

Halal Stock Advisor

We recommend stocks for investors who care about both: performance and Islamic values

- Monthly stock picks

- In-depth company and industry analysis

- Shariah compliance for global stocks

- Join community of savvy Muslim investors

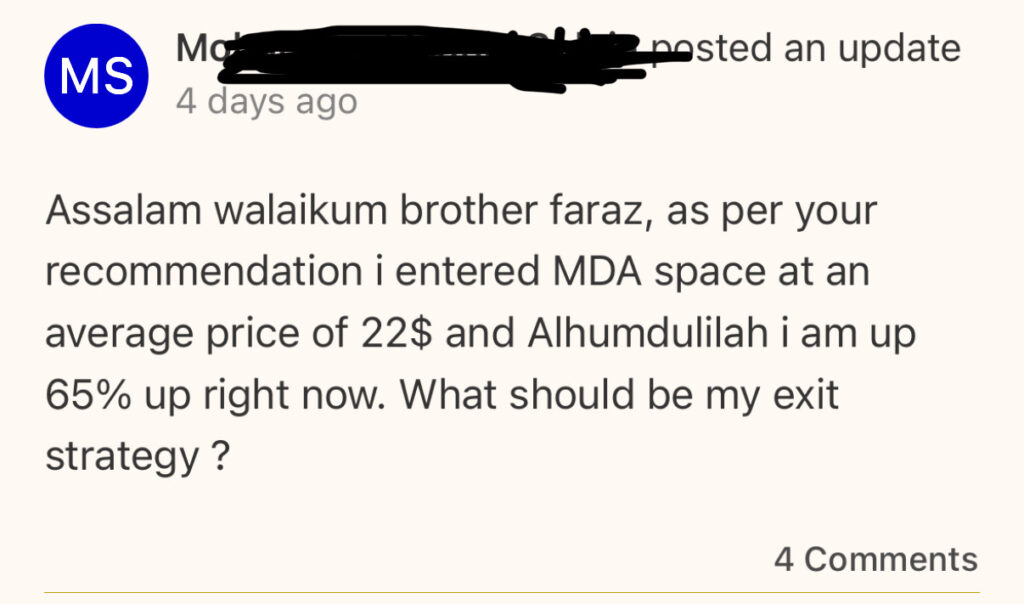

Testimonials